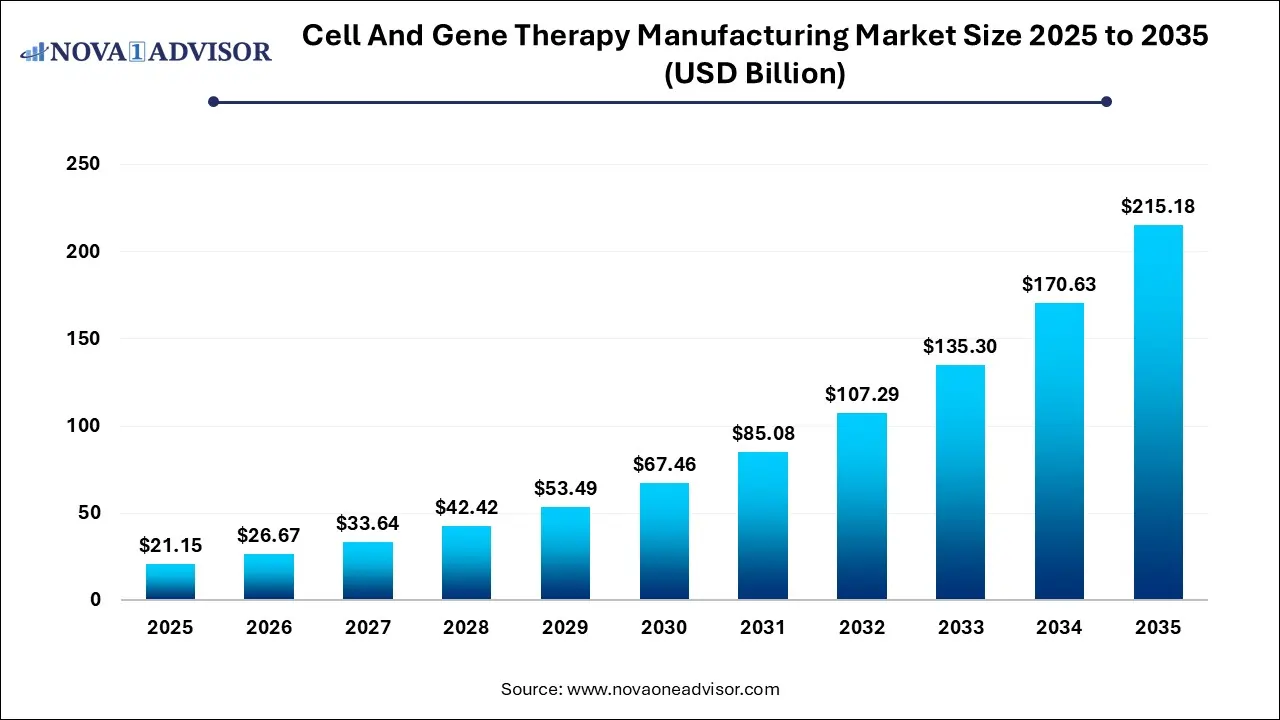

Ottawa, Jan. 29, 2026 (GLOBE NEWSWIRE) -- The global cell and gene therapy manufacturing market size was calculated at USD 21.15 billion in 2025 and is expected to reach around USD 215.18 billion by 2035, growing at a CAGR of 26.11% during the forecast period from 2026 to 2035, a study published by Nova One Advisor, a sister firm of Precedence Research.

The market growth is driven by accelerating FDA approvals, rapid expansion of CDMO capacity, advances in vector and cell processing technologies, and rising global demand for personalized therapies, the market is set to witness strong commercialization momentum across developed and emerging regions.

Cell and Gene Therapy Manufacturing Market Key Takeaways

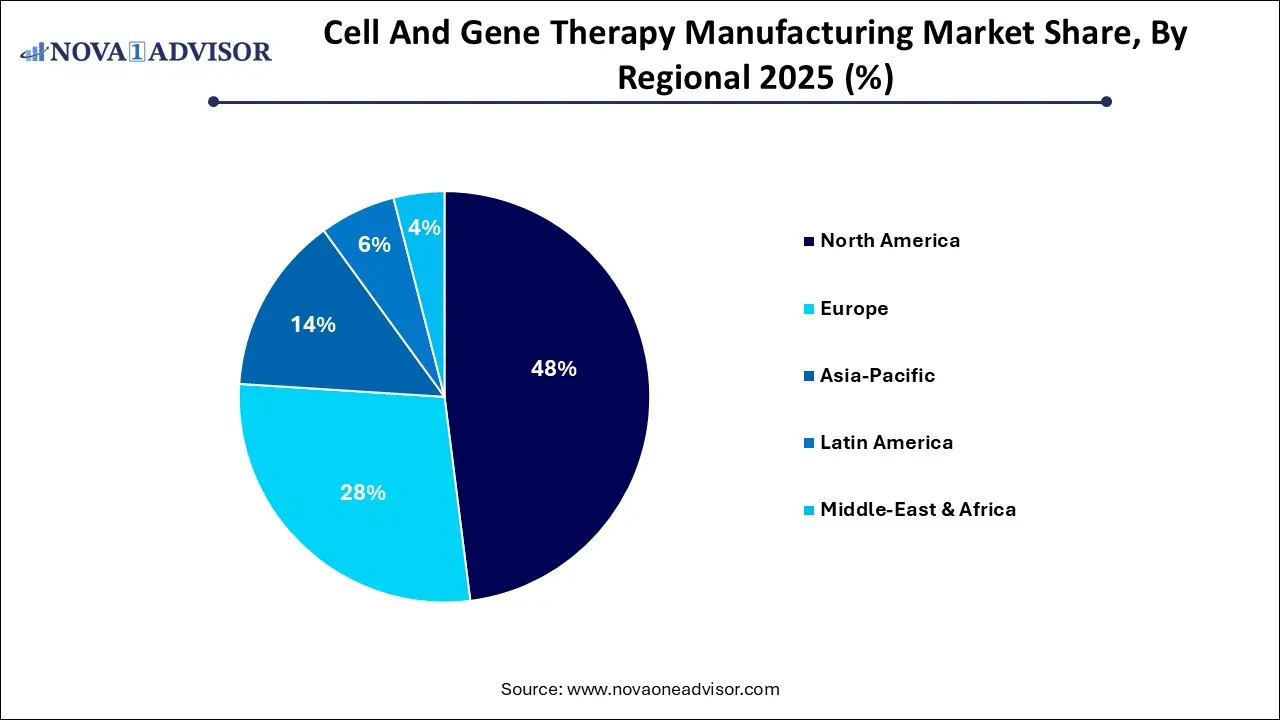

- By region, North America dominated the highest market share of 48% in 2025.

- By region, Asia-Pacific is estimated to expand the fastest CAGR between 2026 to 2035.

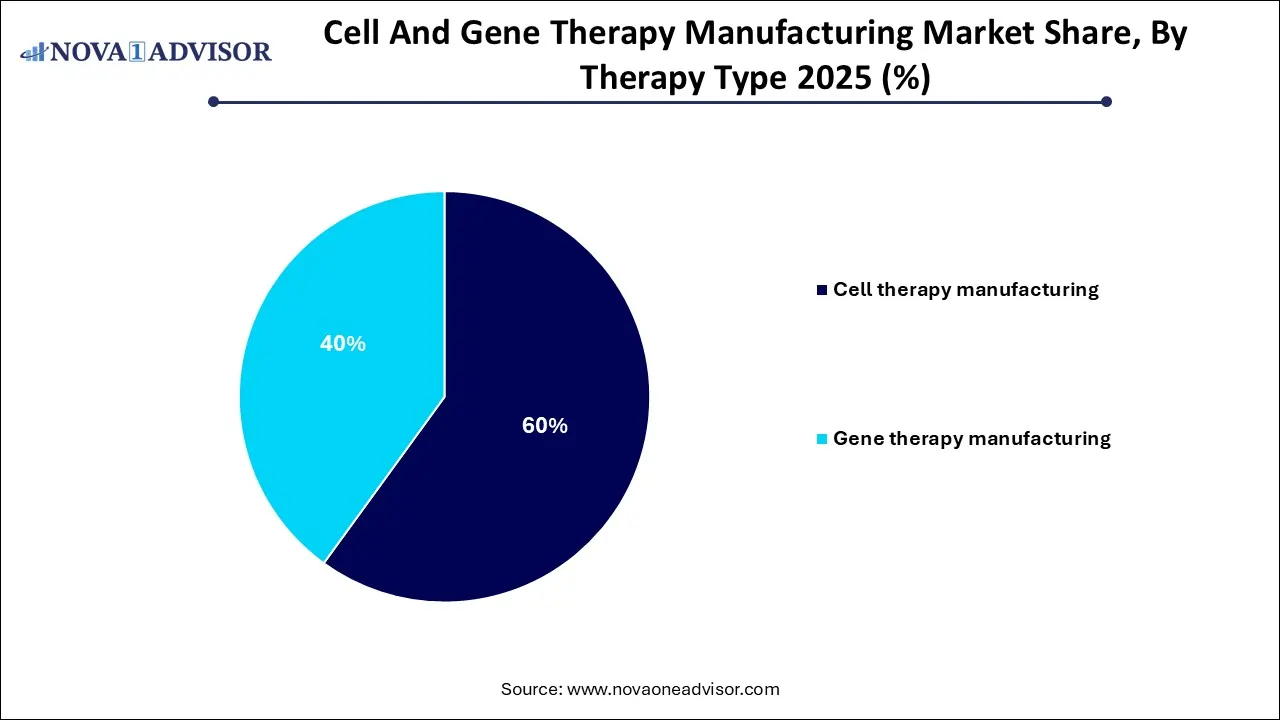

- By therapy type, the cell therapy segment contributed the largest market share in 2025.

- By therapy type, the gene therapy (in vivo) expected to grow at the notable CAGR during the forecast period.

- By vector type, the viral vectors segment generated the maximum market share in 2025.

- By vector type, the non-viral vectors (LNPs) segment is anticipated to grow at the noteworthy CAGR during the forecast period.

- By application, the oncology segment registered the maximum market share in 2025.

- By end user, pharmaceutical and biotechnology companies were the most segment captured the maximum market share in 2025.

- By end user, the CROs and CDMOs segment registered the maximum market share in 2025.

What is Cell and Gene Therapy Manufacturing?

Cell and gene therapy (CGT) manufacturing includes the technology of manufacturing cell and gene-based therapies, which are intended to manage, prevent, or potentially cure diseases by adapting the genetic material. This comprises genetic engineering technology, cell culturing, and various biotechnological processes to produce therapeutic cells, gene-modified cells, or viral vectors. Driven by ardent investor interest and modern technological development, cell and gene therapy manufacturing is becoming one of the life sciences manufacturing’s evolving sectors.

Download a Sample Report Here: https://www.novaoneadvisor.com/report/sample/8437

What are the Key Drivers in the Cell and Gene Therapy Manufacturing Market?

Cell and gene therapy potentially cure disease, particularly in cases where no other therapy has worked. These therapies are given as a one-time dose. This is beneficial compared to some other treatments that needs many doses. Cell and gene therapy have the strength to get rid of a patient’s symptoms for life. This therapy gives many patients an improved quality of life. Gene therapy is able to exist because of massive advances in technology over the past few decades. This therapy offers novel therapies for diseases that presently don’t have many other options, this drives the growth of the market.

For Instance,

- In November 2025, Novartis receives FDA approval for Itvisma, the only gene replacement therapy for children two years and older, teens, and adults with spinal muscular atrophy (SMA).

What are the Ongoing Trends in the Cell and Gene Therapy Manufacturing Market?

- In December 2025, Genetix presents recent patient experience data from U.S. commercial gene therapy implementation at the 67th American Society of Hematology (ASH) Annual Meeting

- In September 2025, an AAV manufacturing partnership supports gene therapy for CLN2 batten disease

What is the Emerging Challenge in the Cell and Gene Therapy Manufacturing Market?

Increasing CGT production from laboratory to commercial production shows tough complexities, unlike those seen in outdated pharmaceutical manufacturing. Unlike chemical compounds, living cells cannot simply be produced in larger batches using superior tools. For this therapy, which use a patient’s own cells, every batch is unique and needs discrete processing, production traditional frugalities of scale problematic to achieve. Allogeneic therapies provide more scalability possible but face their challenges in maintaining consistency in the larger production volumes.

Immediate Delivery Available | Buy This Premium Research: https://www.novaoneadvisor.com/report/checkout/8437

Cell and Gene Therapy Manufacturing Market Report Scope

| Report Attribute | Details |

| Market Size in 2026 | USD 26.67 Billion |

| Market Size by 2035 | USD 215.18 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 26.11% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Therapy Type, By Scale, By Mode, By Workflow |

| Market Analysis (Terms Used) | Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Lonza; Bluebird Bio; Catalent Inc.; F. Hoffmann-La Roche Ltd.; Samsung Biologics; Boehringer Ingelheim; Cellular Therapeutics; Hitachi Chemical Co., Ltd.; Bluebird Bio Inc.; Takara Bio Inc.; Miltenyi Biotec; Thermo Fisher Scientific; F. Hoffmann-La Roche Ltd; Novartis AG; Merck KGaA; Wuxi Advanced Therapies |

For more information, visit the Nova One Advisor website or email the team at sales@novaoneadvisor.com | Call us: +1 804 420 9370

Cell and Gene Therapy Manufacturing Market Segmental Insights

Therapy Type Insights

Which Therapy Type Led the Cell and Gene Therapy Manufacturing Market in 2025?

The cell therapy segment accounted for the dominating share of the market in 2025, as this therapy has been proven to supports the patients living with chronic diseases such as diabetes, arthritis, Parkinson’s disease, and burn victims. It also supports with spinal injuries and the aging process. Cell therapy has established efficiency in promoting tissue regeneration, lowering inflammation, and increasing healing times.

Whereas the gene therapy segment is predicted to register rapid expansion in the forecasting period, as gene therapy plays significant role in the treatment for genetic disorders. It works by moreover changing a disease-causing gene or giving a working copy of that gene. Gene therapy works by either changing how the disease-causing gene works or offering a working copy of the gene to make a protein body required.

Vector Type Insights

Which Vector Type Dominates the Market in 2025?

In 2025, the viral vectors segment captured the biggest share of the cell and gene therapy manufacturing market, as they are widly used to deliver target or therapeutic genes during gene therapy. The vector is beneficial for stabilizing the gene of interest into the target cell genome. These vectors successfully deliver genes to non-dividing and difficult-to-transduce cells.

Although the non-viral vectors (LNPs) segment will expand fastest during 2026-2035, as non-viral gene vectors provide many benefits including broad raw materials, elastic chemical composition, simply modulated topology, high DNA loading and safety. Non-viral vectors mainly include LNP, cationic polymers, exosomes. Non-viral vectors have many advantages such as safety, efficiency, and easy manufacturing, possessing potential healthcare application value as compared with viral vectors.

Application Insights

How did the Oncology Dominate the Market in 2025?

In 2025, the oncology segment had the largest share in the cell and gene therapy manufacturing market, as gene therapy is an element of cancer cell and gene therapy in which investigators modify the DNA and genetic function of immune cells. Gene replacement therapy introduces functional copies of imperfect or missing genes in the cancer cells to re-establish normal cellular function.

On the other hand, the rare and genetic disorders segment is expected to grow most rapidly between 2026 and 2035, as cell and gene therapies hold significant potential for manaing rare diseases by targeting a illness’s genetic roots. With continuing research and clinical trials, these therapies renovate the treatment processes for numerous patients suffering from conditions earlier deemed fatal.

End-User Insights

How did the Pharmaceutical & Biotechnology Companies Dominate the Market in 2025?

The pharmaceutical & biotechnology companies segment held the largest share of the Cell and gene therapy manufacturing market in 2025, as these therapies has lower price, quick supply of industrial products in response to healthcare demand and ideal organization. Pharmaceutical organization are harnessing cell and gene therapy to tackle complex healthcare conditions and advance therapeutic choices.

Whereas, the CROs & CDMOs segment will expand fastest during 2026-2035, as this therapy accelerate the manufacturing of product and confirm it meets the uppermost regulatory standards while maintaining effective production timelines via an integrated global network of contract development and manufacturing organization (CDMO) services and testing sites. CDMOs rationalize the transition from preclinical expansion to GMP production, often saving months in manufacturing timelines.

Cell and Gene Therapy Manufacturing Market Regional Insights

Why did North America Dominate the Market in 2025?

North America is led in the market as increasing partnership among the public and private organizations, research development, and robust investor support. With continuing invention in research, healthcare development, and government frameworks. The integration of scientific progress and guidelines initiatives is shaping the future of these transformative therapies, which contributes the growth of market.

How did the Asia Pacific Grow Notably in the Market in 2025?

Asia Pacific segment is fastest growing in the market as an increasing demand for innovative therapies including CGTs. Growing patient demand and a thriving ecosystem of innovation. Rising an urgent required for developed therapies, urging the push for novel treatment strategies. There has been a surge in government and regulatory support for CGT trials, in combination with drives the investments for these products, this contributes the growth of the market.

Cell and Gene Therapy Manufacturing Market Top players

- Lonza: Lonza is a global CDMO specializing in biologics, cell and gene therapy manufacturing. The company supports biopharma firms across development, clinical, and commercial stages with advanced production capabilities.

- Bluebird Bio Inc.: Bluebird Bio is a biotechnology company focused on developing gene therapies for severe genetic and rare diseases. It is known for its lentiviral vector–based therapies and commercial gene therapy launches.

- Catalent Inc.: Catalent is a leading drug development and delivery company providing advanced manufacturing solutions. It has strong expertise in biologics, cell and gene therapy, and clinical supply services.

- F. Hoffmann-La Roche Ltd.: Roche is a global healthcare leader with strengths in pharmaceuticals and diagnostics. The company is heavily invested in precision medicine, oncology, and advanced biologics research.

- Samsung Biologics: Samsung Biologics is a major contract manufacturing organization for biologics. It offers large-scale biologic drug substance and drug product manufacturing with state-of-the-art facilities.

- Boehringer Ingelheim: Boehringer Ingelheim is a research-driven pharmaceutical company with strong biologics and biomanufacturing capabilities. It actively supports biologics and advanced therapy production for external partners.

- Cellular Therapeutics: Cellular Therapeutics focuses on cell-based therapies and regenerative medicine solutions. The company supports innovation in immune-cell engineering and therapeutic development.

- Hitachi Chemical Co., Ltd.: Hitachi Chemical provides advanced materials and technologies for life sciences and healthcare applications. It supports bioprocessing, diagnostics, and pharmaceutical manufacturing infrastructure.

- Bluebird Bio Inc.: Bluebird Bio develops transformative gene therapies targeting rare genetic disorders. Its pipeline emphasizes long-term disease modification through genetic correction.

- Takara Bio Inc.: Takara Bio specializes in gene therapy tools, reagents, and CDMO services. The company supports viral vector manufacturing and cell therapy development globally.

- Miltenyi Biotec: Miltenyi Biotec is a leader in cell separation, cell processing, and immune cell technologies. It provides integrated solutions for research, clinical development, and cell therapy manufacturing.

- Thermo Fisher Scientific: Thermo Fisher Scientific supplies analytical instruments, reagents, and bioproduction services. It plays a critical role in supporting biopharma R&D and commercial manufacturing worldwide.

- F. Hoffmann-La Roche Ltd.: Roche focuses on innovative biologics, diagnostics, and personalized healthcare solutions. Its strong R&D capabilities drive leadership in oncology and rare disease treatments.

- Novartis AG: Novartis is a global pharmaceutical company with strong expertise in gene and cell therapies. It is known for commercializing advanced therapies and investing heavily in innovation.

- Merck KGaA: Merck KGaA operates across healthcare, life science, and electronics sectors. Its life science division provides bioprocessing tools and solutions for advanced therapy development.

- Wuxi Advanced Therapies: Wuxi Advanced Therapies is a CDMO focused on cell and gene therapy manufacturing. It offers end-to-end services from process development to commercial production.

What are the Recent Developments in the Cell and Gene Therapy Manufacturing Market?

- In August 2025, Abeona therapeutics received FDA approval for ZEVASKYN first autologous gene therapy for recessive dystrophic epidermolysis bullosa with launch expected in 2025.

- In July 2025, Myrtelle launched Manufacturing of First-in-Class Gene Therapy for Canavan Disease in Strategic Alliance with Charles River and Viralgen.

More Insights Nova One Advisor:

- Cell and Gene Therapy CDMO Market: The global Cell and Gene Therapy CDMO market size was estimated at USD 10.35 billion in 2025 and is projected to hit around USD 125.09 billion by 2035, growing at a CAGR of 28.3% during the forecast period from 2026 to 2035.

- Cell and Gene Therapy Bioanalytical Testing Services Market: The global cell and gene therapy bioanalytical testing services market size was valued at USD 629.85 million in 2025 and is projected to surpass around USD 1,310.27 million by 2035, registering a CAGR of 7.6% over the forecast period of 2026 to 2035.

- U.S. Cell and Gene Therapy Clinical Trial Services Market: The U.S. cell and gene therapy clinical trial services market size was valued at USD 12.25 billion in 2024 and is projected to surpass around USD 90.44 billion by 2035, registering a CAGR of 22.13% over the forecast period of 2025 to 2034.

- U.S. Computational Biology Market: The U.S. computational biology market size was valued at USD 3.65 billion in 2025 and is projected to surpass around USD 12.00 billion by 2035, registering a CAGR of 12.64% over the forecast period of 2026 to 2035.

- U.S. Drug Discovery Outsourcing Market: The U.S. drug discovery outsourcing market size was exhibited at USD 3.78 billion in 2025 and is projected to hit around USD 9.28 billion by 2035, growing at a CAGR of 9.4% during the forecast period 2026 to 2035.

- U.S. High Potency Active Pharmaceutical Ingredients Market: The U.S. high potency active pharmaceutical ingredients market size was valued at USD 32.65 billion in 2025 and is projected to surpass around USD 78.8 billion by 2035, registering a CAGR of 9.19% over the forecast period of 2026 to 2035.

- U.S. Diagnostic Imaging Services Market: The U.S. diagnostic imaging services market size was exhibited at USD 154.22 billion in 2025 and is projected to hit around USD 275.66 billion by 2035, growing at a CAGR of 5.98% during the forecast period 2026 to 2035.

Segments Covered in the Report

By Therapy Type

- Cell therapy manufacturing

- Stem cell therapy

- Non-stem cell therapy

- Gene therapy manufacturing

By Scale

- Pre-commercial/ R&D scale manufacturing

- Commercial scale manufacturing

By Mode

- Contract manufacturing

- In-house manufacturing

By Workflow

- Cell processing

- Cell banking

- Process development

- Fill & finish operations

- Analytical and quality testing

- Raw material testing

- Vector production

- Others

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research https://www.novaoneadvisor.com/report/checkout/8437

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Our Trusted Data Partners

Towards Chemical and Materials | Precedence Research | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Nova One Advisor

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 420 9370

Email: sales@novaoneadvisor.com

For Latest Update Follow Us: LinkedIn